Takeaways at a glance:

The ambulatory care setting is maturing:

- The ASC market is growing, with more ambulatory care providers coming onto the scene

- Demand for care delivered by Ambulatory Surgery Centers is increasing, as patients get more involved in their choice of provider.

- ASCs are on an efficiency drive to improve their competitive edge.

- Tools to boost supply chain efficiency in the surgery setting are central to increased efficiency in two key areas:

- Implant management

- POU data capture

This article is suitable for ASCs looking to find solutions that enable them to improve clinical and operational performance.

The ambulatory healthcare sector is booming – it’s about to get busy, real busy!

ASCs can no longer rely on slow, inefficient systems such as paper-based or key-in processes, and long, elaborate workflows. It’s time for ambulatory service providers to step up and embrace new technology, or risk getting left behind.

What is fueling ASC growth?

Medicare and Medicaid have been approving additional lower risk procedures for ASC delivery, so it’s no coincidence that 2022 has seen the opening, or announcement, of 129 new ASCs*1.

Some of these ASCs will be independent, but others may be joint ventures with hospital affiliation. In a survey from 2019 48% of hospital respondents with current ASC ownership or affiliations “anticipated making additional ASC investments or affiliations in the coming years.” *2

The market is both growing and evolving, with everyone wanting a piece of the ASC pie!

Why is there increasing demand for ambulatory care?

Cheaper, more localized delivery of routine healthcare is now a definite trend.

- Patients are attracted to the ambulatory care setting by the lower cost of surgery – with ASCs undercutting hospital surgical rates by 35-50%*2.

- In the past patients just booked themselves in to the closest hospital, but there is now evidence that 70% of patients are researching copay rates before deciding where to go*3.

- ASCs are reducing US healthcare costs by over $38 billion a year*4

Although there is increasing demand the picture isn’t all rosy. ASC providers are struggling with supply chain disruptions and price hikes, as well as an increasingly expensive workforce due to sector-wide staff shortages.

With the cost of healthcare provision increasing, plus the stress of additional competition and the strain of higher demand, ASCs need to tighten up their operations and adapt to the changing sector. It’s the leaner, smarter providers who will likely get the biggest share of the pie.

Adding automation and reducing unnecessary admin can really tighten up surgery workflows – and it’s probably simpler and cheaper to implement than ASC leaders initially imagine.

Higher demand requires better efficiency

ASCs are joining the techno party late, as the price of digital transformation initially prevented their entry. ASCs weren’t able to access the hospital grants made available for digital EHR systems, and consequently many still use paper records. This disparity needs to be addressed in order for ASCs to move forward at the same speed as the market is moving.

There is an assumption that electronic health records are common-place these days, but just taking New York as an example, more than a third of the 157 ASCs in New York do not have EHRs*5.

So, it’s catch-up time now, and ASCs will need to invest in technology in order to compete.

Supply chain boosters for ASCs

Knowledge is power – so, we’re going to highlight two ASC-centric ‘must-have’ tools that will revolutionize the way you manage and control your medical inventory supply chain.

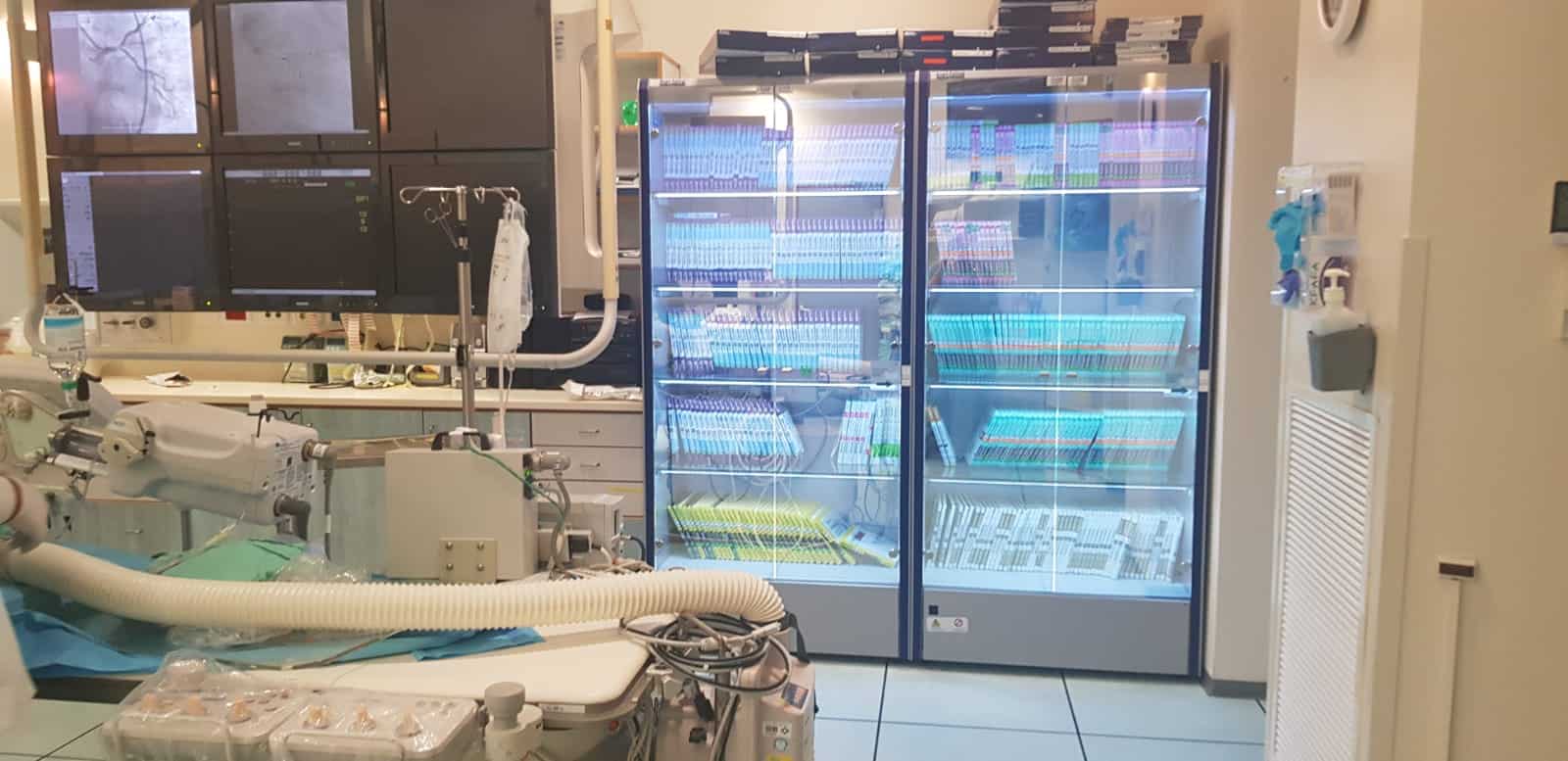

a) Implant and medical device management

It’s a known fact that nursing staff spend way too long hunting down the high value stock they need for surgery. All too often items:

- Get removed from cabinets that are not used, yet never returned.

- Are sent to other departments without any note being made of the move.

- Become expired and get discarded.

- Get wasted.

In fact, there are so many reasons that stock items go missing and are simply not where they’re supposed to be when the nurse reaches out for them.

That’s why investing in new generation, smarter RFID Cabinets can have a big impact. The right cabinet can save nursing staff 75% of their working day simply by keeping track of all items and providing full visibility. The automated restocks generated when the reorder point is reached also save time and prevent stock-outs.

Effective smart cabinets will provide greater inventory control, lower costs and significantly reduce the time nurses spend on supply chain tasks.

b) POU data capture

The point of care is another area where perioperative nurses get bogged down with unnecessary inventory admin.

Documenting every item used in surgery has become a time consuming and complex task. Achieving full POC utilization documentation makes sound business sense – recording accurate usage data ensures UDI compliance, improved inventory management and full revenue generation.

That’s why savvy ASCs are investing in a groundbreaking POU data capture solution that doesn’t rely on outdated bar codes. It uses patented image-recognition technology, for quick and accurate itemization at the point of care.

As the ambulatory care market expands there are new tech solutions available that deliver the clinical and operational performance boost that ASCs are searching for.

If your ASC is serious about increasing its market share – it’s time for a tech-upgrade!

*1 129 ASCs opened, announced in 2022 (beckersasc.com)

*2 Ambulatory Surgery Center Growth Accelerates: Is Medtech Ready? | Bain & Company

*3 HOPDs vs. ASC: Understanding Payment Differences (hfma.org)

*4 ASCs vs. HOPDs: 12 insights on the federal reimbursement gap (beckersasc.com)

*5 https://www.beckersasc.com/leadership/the-investment-ascs-can-t-afford-to-skip.html