What’s inside:

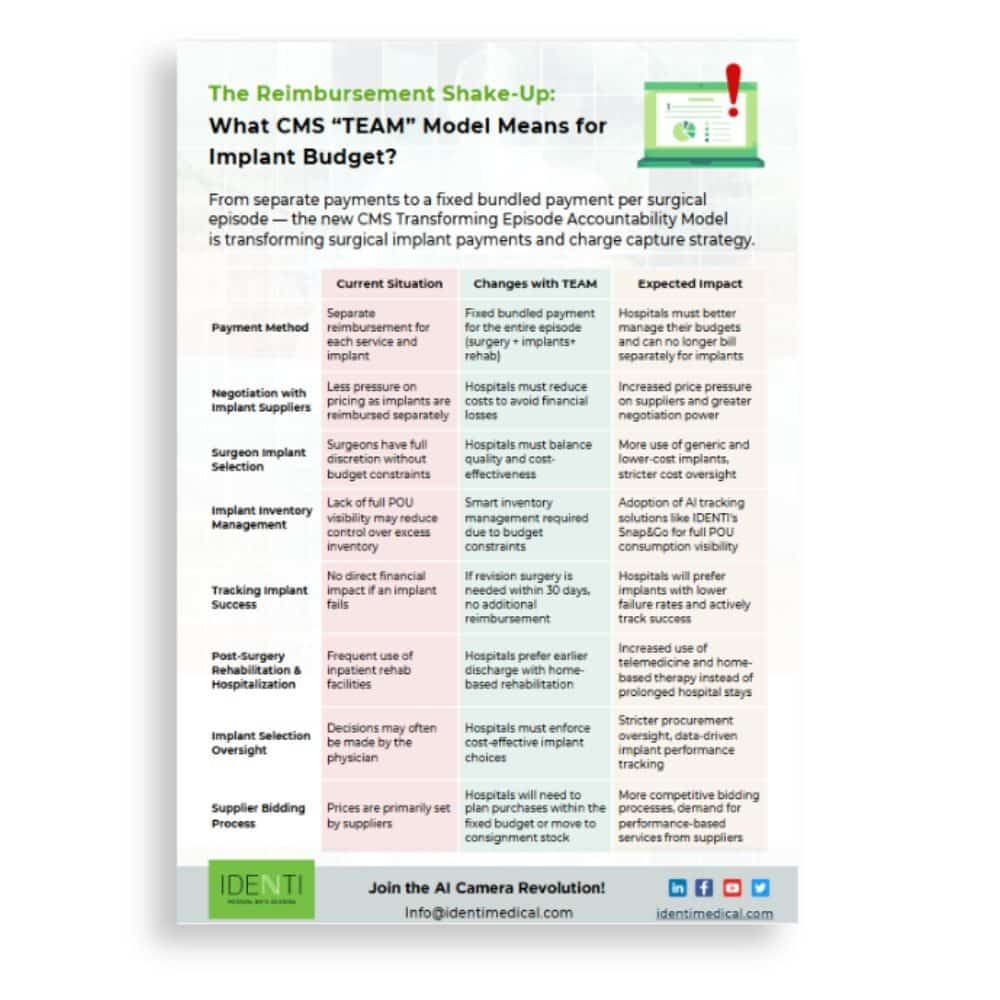

- Medical coding for high-cost implants is undergoing a major transformation.

- With the introduction of the CMS Transforming Episode Accountability Model (TEAM), hospitals must shift from separate billing for implants to bundled payments per surgical episode.

- This change significantly impacts medical coding, charge capture, and inventory management, requiring a new level of precision in documentation and cost control.

The Big Shift in Surgical Implant Payments and Medical Coding

The Transforming Episode Accountability Model (TEAM) is a new Medicare payment model that bundles payments for entire episodes of care. Starting January 1, 2026, TEAM will run for five years as a mandatory program targeting select hospitals across 188 geographic regions. It covers five high-cost, high-volume surgical procedures: lower extremity joint replacement, surgical hip/femur fracture treatment, spinal fusion, coronary artery bypass graft (CABG), and major bowel procedures. Under TEAM, Medicare provides a single target price for all services related to the surgery, including the inpatient procedure and all items and services for 30 days post-discharge. Hospitals continue to bill Medicare fee-for-service for each claim, but later face reconciliation against the bundled target: if total episode spending is below the target (with quality goals met), the hospital may share in savings; if above, the hospital must repay the difference. This shifts financial accountability to hospitals for the full episode of care, incentivizing coordination and cost control while maintaining or improving quality.

Importantly, implants and devices used during the surgery are included in the episode costs – there is no separate reimbursement for the implant itself under the bundle. TEAM builds on prior CMS bundled payment initiatives (like BPCI Advanced and CJR) and aims to drive value by holding hospitals accountable for cost and quality. Given that the targeted surgeries account for over 11% of all inpatient Medicare spending, the stakes are high. Hospitals in affected regions are now preparing for this reimbursement shake-up, knowing that managing episode costs (costly implants and post-acute care) will be critical to financial success.

Impact on High-Cost Implant Management and Medical Coding

One of the biggest implications of TEAM is how hospitals manage high-cost implants (artificial joints, spinal hardware, cardiac devices, etc.) under a fixed bundled payment. These implants often represent a large share of surgical costs – studies have found implant costs can constitute 40–65% of the total cost in procedures like joint replacements. Under fee-for-service, the high price of an implant would be built into the DRG payment or passed along to payers/patients, and extremely costly cases might even qualify for outlier payments. Now, with a predetermined episode budget, every dollar spent on an implant comes out of the hospital’s pocket unless offset elsewhere. This dynamic is forcing several changes in practice:

- Aggressive Price Negotiations with Suppliers: Hospitals will push for better pricing on implants to meet budget targets. With no extra payment coming for a premium-priced implant, hospitals gain leverage to demand discounts from vendors. Some health systems have already achieved significant savings by creating competition among implant suppliers – for example, Indiana University Health cut its hip and knee implant costs by ~25% through transparent vendor bidding and surgeon engagement programs. We can expect more hospitals to negotiate volume-based pricing, bulk purchasing contracts, and even consider alternative suppliers (including generic or lesser-known implant brands) to reduce unit costs. In prior bundled payment programs, hospitals indeed tended to choose lower-cost implants and were cautious about adopting new, expensive technologies. The flip side is that hospitals must ensure cost-cutting doesn’t compromise quality; implant selection will be scrutinized for value (outcomes per cost) more than ever.

- Surgeon Alignment on Cost-Effective Choices: Under TEAM, surgeons and hospitals have a shared financial fate for the episode. Surgeons historically have had broad discretion in choosing implant brands and models, sometimes favoring the latest devices or personally preferred vendors. Now hospitals will need surgeons to weigh cost in their decisions. Many hospitals are forming implant selection committees or providing surgeons with data on implant pricing and performance. For instance, posting implant cost scorecards (e.g., red/yellow/green pricing tiers) has helped drive conversations about value. The goal is not to dictate clinical decisions, but to encourage the use of cost-effective implants that achieve equal patient outcomes. In some cases, this might mean standardizing on a few preferred implants to get volume discounts, or using “generic” implants if evidence shows they perform similarly to more expensive branded ones. Hospitals will also likely ask surgeons to work with supply chain teams in evaluating new implant technologies – balancing the potential clinical benefits against the added cost within a TEAM budget.

- Tighter Implant Inventory Management: Because implant costs now directly hit the hospital’s bottom line, there is a strong incentive to eliminate waste and inefficiency in inventory. In the past, OR implant inventory might have been overstocked “just in case,” or consignment stock agreements with vendors might not have been optimized. Under a bundled model, unused or expired implants on the shelf are an avoidable cost. Hospitals are investing in smarter inventory practices: ensuring the right implant sizes and types are on hand but not excessive, turning to consignment arrangements where the hospital only pays when an item is used, and closely tracking implant usage trends. Real-time visibility into implant usage at the point of use is key to this effort (discussed more under technology solutions). By tightening inventory control, hospitals can avoid the hidden costs of expired products and reduce carrying costs, which helps preserve the narrow margins in a fixed payment scenario.

- Focus on Implant Outcomes and Reliability: Since the episode payment covers a 30-day post-op window, if an implant fails or a complication occurs that requires re-operation or readmission within that period, the hospital typically cannot bill extra for it. This is a stark change – for example, under traditional payment, a failed implant that necessitated a revision surgery would generate a separate reimbursement for that new surgery, but under TEAM, it would likely fall within the original episode (meaning no additional payment). As a result, hospitals have a heightened interest in the quality and track record of the implants they use. Devices with lower failure rates and proven outcomes become even more valuable. We may see hospitals favor implants with strong clinical data and even negotiate warranties or performance guarantees from manufacturers. Some device makers offer warranties (e.g., credit or replacement at no cost if an implant fails early); ensuring such programs are in place can protect the hospital from some financial loss. Moreover, hospitals will actively monitor patient outcomes by implant type – if one brand is associated with more complications or higher readmission costs, that will factor into value analysis. Avoidable readmissions are particularly costly:

A recent analysis showed the average cost of a single readmission in these episodes is about $15,100, which would come out of the hospital’s bundled payment. Reducing surgical complications and infections (through better pre-op optimization, surgical technique, and post-op care) becomes critical not just for quality metrics but to avoid financial penalties.

- Post-Acute Strategy and Implant Choices: Interestingly, implant selection can also influence post-acute care needs. For example, a knee replacement implant that enables quicker mobilization might help discharge a patient home sooner rather than to a costly rehab facility. Under TEAM, hospitals are incentivized to minimize expensive post-acute services (skilled nursing facility stays, inpatient rehab) when possible in favor of home-based recovery. They will consider whether certain implant technologies could reduce length of stay or therapy needs. Overall, the hospital’s care protocol from surgery through recovery will be tuned to control costs: shorter hospital stays, efficient therapy, telehealth follow-ups, and preventing any complications that require intervention. Implants are one piece of this puzzle – a reliable implant that facilitates a smooth recovery aligns with both clinical success and cost containment.

It’s worth noting that while cost pressure is the theme, value-based decisions must prevail. Hospitals will not simply choose the cheapest implant; they will choose the one that offers the best outcome for the price. If a more expensive implant demonstrably reduces complications or long-term failures, it may justify its cost by avoiding downstream expenses (even if those expenses might occur outside the 30-day window). However, since TEAM’s financial window is limited to 30 days post-surgery, there is concern that hospitals might under-invest in innovations that primarily show benefits long after 30 days. For example, a surgical implant that slightly lowers 1-year revision rates but is significantly pricier might be viewed as financially unattractive under a 30-day model. Researchers have warned that bundling programs could inadvertently incentivize hospitals to adopt new technology more slowly due to cost concerns. This calls for careful monitoring. Hospitals will need to collaborate with surgeons to ensure that cost containment efforts do not lead to higher, longer-term complication rates. CMS and device manufacturers will also be watching outcomes; if revision rates climb or patients lose access to advanced implants, adjustments to the model or new payment carve-outs might be considered. In the meantime, hospital leaders are tasking their value analysis committees to rigorously vet implants on both clinical and economic grounds, aiming to strike the right balance between innovation and cost-effectiveness in the TEAM era.

Medical Coding and Compliance Challenges

While TEAM changes how hospitals are ultimately paid, it does not eliminate the need for detailed medical coding and charge capture – in fact, it makes accurate medical coding more crucial than ever. Hospitals still submit claims for each encounter (the inpatient surgery, any readmissions, outpatient visits, etc.) using the usual medical coding systems (ICD-10-PCS/CPT for procedures, HCPCS for devices/supplies, ICD-10-CM for diagnoses). These codes form the basis of Medicare’s calculation of episode spending and are subject to audits and compliance rules, just as before. Several medical coding and billing challenges require attention under the TEAM model:

Complete Charge Capture (Avoiding Under-Coding):

Missing documentation of an implant or procedure means the hospital doesn’t get credit for it in their claims data – effectively providing a service or product without reimbursement. In traditional fee-for-service, that’s lost revenue; in a bundled context, it could also skew the hospital’s reported episode costs. Unfortunately, charge capture misses are common. Surveys of revenue cycle leaders show that in most hospitals, between 1% and 10% of all charges are not captured (under-coded) due to documentation gaps, and about 20% of hospitals reported that more than 10% of charges go missing. High-cost implants are a known trouble spot: complex surgeries involve numerous supplies and implants, and manual recording errors can lead to an item not being billed. For example, if a surgical screw or implantable device isn’t entered into the system, the case’s cost is still incurred, but no charge appears on the claim. Under TEAM, failing to code an implant means the hospital eats that cost with no chance of reconciliation later. It’s critical that every implant and billable supply used in the episode is documented with the correct codes. This includes using the proper HCPCS Level II codes for implants or supplies when required (even if they’re typically “packaged” charges) so that claims data accurately reflect the resources used. Hospitals are reviewing their charge capture processes in the OR to plug gaps – often, this means deploying technology or revising workflows (discussed in the next section). In sum, with margins tightening, hospitals can’t afford to lose 5-10% of implant charges due to clerical errors. Industry estimates suggest that 10–15% of implant-related revenue is lost today because of charge capture errors or missed billing opportunities, which highlights the need to improve this process.

Avoiding Over-Coding and Billing Errors:

On the flip side, “over-coding” or adding charges that aren’t documented or not actually used is a serious compliance risk. In a bundled payment, one might think there is temptation to upcode to get higher interim payments (since reconciliation comes later). However, Medicare will still enforce all medical coding rules and pursue audits for improper claims. Overstating charges can trigger fraud and abuse penalties, and it doesn’t truly benefit the hospital long-term under TEAM (because final settlement will account for actual costs anyway). A survey found that more than half of hospitals believed 1–10% of their charges were over-coded, and 14% said over-coding affected >10% of charges – often due to complexity or errors rather than intentional fraud. But any over-coded claims can lead to paybacks or even fines once audited. CMS has signaled it will be closely monitoring claim accuracy; in fact, 56% of hospitals in one study had been audited by CMS or other payers multiple times. Under TEAM, hospitals must maintain robust medical coding compliance programs: ensuring procedures are coded to the correct extent (no adding unwarranted CPT codes), implants are only billed if actually implanted, and any duplicate or erroneous charges are corrected. Clinical documentation improvement (CDI) specialists and medical coding auditors will play a vital role in this environment. The bottom line is that medical coding accuracy (both completeness and correctness) is paramount – hospitals need to capture all legitimate charges but not a penny more. This requires clear communication between surgical teams and medical coding /billing staff so that documentation supports all coded items.

HCPCS Device Codes and Modifiers Compliance:

• Many surgical implants have associated HCPCS codes or require special billing notations. For example, in hospital outpatient claims, certain implants might be reported with HCPCS “C-codes” (even though payment is bundled into the procedural payment) to provide CMS with cost data. In inpatient claims, when an implanted device is provided at no cost or with a deep discount (such as replacement under warranty or recall), Medicare requires hospitals to use specific modifiers and value codes to reduce the payment accordingly. Compliance in this area has historically been poor – the OIG has repeatedly audited hospitals for failing to report device credits properly, resulting in overpayments. Under TEAM, these rules still apply. Hospitals must have workflows to track manufacturer credits for failed implants and ensure the claim reflects any such credit (using condition code 49 or 50, value code FD, etc., per Medicare policy). If they don’t, they risk audits and having to refund Medicare for the implant portion of the payment. This is just one example of the detailed medical coding requirements that remain in force. Even though TEAM changes reimbursement structure, hospitals must stay vigilant on all Medicare medical coding and billing regulations – from device credits, to the correct use of CPT modifiers (like -59, -XU for distinct services when appropriate), to adherence to National Correct Coding Initiative (NCCI) edits. Non-compliance can lead to financial penalties that nullify any gains from the model.

Unique Device Identifier (UDI) Documentation:

Another layer of complexity is the requirement (from the FDA and supported by CMS/ONC rules) to document the UDI of implanted medical devices in the patient’s health record. The UDI is a code that includes the specific device identifier and its lot or serial number. Capturing UDIs is crucial for patient safety (it allows tracking of exactly which device a patient received in case of recalls or safety alerts) and for quality data. Many EHRs now have fields to record UDI information for implants, and some CMS quality programs encourage UDI capture. However, getting that data into the record is often a manual step during or after surgery. It requires staff to scan a barcode or type in a long string of characters from the implant packaging. If done manually, it’s time-consuming and prone to error – yet if not done, the hospital could be out of compliance with documentation requirements and lose the ability to easily trace implants. Thus, hospitals face a challenge: how to efficiently record every implant’s UDI (and associated details like lot, expiration date) into the system without slowing down the surgical workflow. This is where technology is increasingly being looked at to assist (for example, scanning systems or AI-based solutions can automate UDI capture – see next section). Compliance with UDI documentation ties into both safety and potential future billing requirements (there have been recommendations to eventually include UDI on claims, although Medicare hasn’t done so yet). For now, hospitals should treat UDI capture as a compliance must-have and a risk mitigation (for recalls), bundling that task into the implant documentation workflow. It adds to the administrative burden if done manually, which again points to the need for better tools.

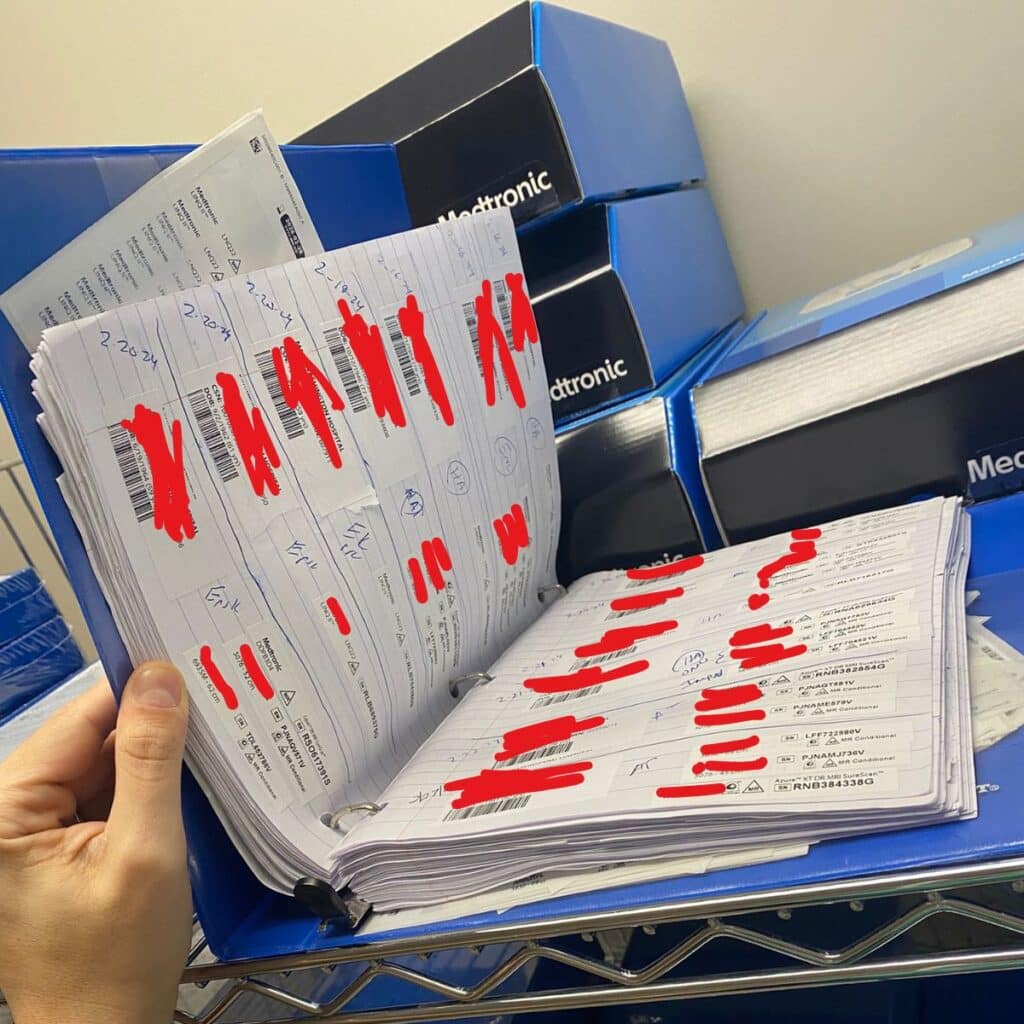

In summary, the TEAM model doesn’t reduce the complexity of medical coding – if anything, it raises the stakes on medical coding precision and charge capture. Hospitals will need to break down silos between clinical, billing, and supply chain departments to ensure that every implant and service is documented correctly and promptly. The operating room, where high-cost implants are used, is a focal point: historically, implant usage might be recorded on paper implant logs or via stickers placed on forms, to be keyed into the system later. Such antiquated processes are error-prone and too slow for the demands of modern revenue cycle management. As we’ll discuss next, hospitals are turning to automation and AI-driven solutions to address these challenges, improve accuracy, and maintain compliance in the face of the new payment model.

Download to learn more about the CMS “TEAM” model and implant tracking>>

AI-Powered Solutions for Implant Tracking and Medical Coding

To thrive under TEAM’s constraints, hospitals are looking to technology – especially AI-driven tracking solutions – to modernize how implants and other surgical supplies are documented. Traditional methods of implant charge capture involve a lot of human effort: a nurse peels barcoded stickers off implant packages and sticks them on a paper chart or OR record; someone later transcribes those into the electronic record or billing system; a materials manager cross-checks vendor invoices (for “bill-only” implants that weren’t in stock) against what was documented; and so on. This manual, multi-step workflow is cumbersome and error-prone. It often leads to delays (charges not entered for days) and mistakes (missed items or typos), contributing to the revenue leakage and compliance issues noted above. In the face of a model like TEAM, which demands efficiency and accuracy, hospitals are increasingly embracing automation at the point-of-use to ensure no implant goes untracked. Several advanced solutions are making inroads:

In the operating room, AI-powered systems can capture implant usage with a quick scan or photo. In this example, a nurse uses the Snap&Go image recognition device to document a high-cost implant in seconds. Such tools integrate with hospital IT systems to automatically log the product, its unique ID, and charge code, eliminating manual data entry.

Computer Vision and Image Recognition:

One of the most exciting developments is AI that can literally “see” the implant packaging and record its details. For instance, IDENTI Medical’s Snap&Go system uses a special camera and AI software to identify implants and supplies by their package labels. Instead of scanning barcodes one by one (which often fails if there are multiple barcodes or if staff forget to scan a small item), the nurse can simply place the item under a camera or snap a picture with a tablet/phone, and the system’s computer vision algorithm recognizes the item. The AI pulls the full UDI data from the package (device model, lot/serial number, expiration date, etc.) and matches it to the hospital’s item master or a global database. Instantly, it can populate the patient’s electronic record and charge system with the exact item used, the quantity, and link it to the proper medical coding, also known as billing code. This process provides “visual proof of use” – essentially a photo record that the item was indeed used on that case – adding an extra layer of accountability. The impact on workflow is significant: nurses spend far less time charting supplies and more time on patient care, and every implant (even small screws or components) gets captured. Advanced systems can even recognize “bill-only” items and unpackaged components (like screws, plates, and implants that come in sets) that traditionally might be missed. By automating utilization documentation in real time, hospitals approach the ideal of 100% charge capture for implants. This directly addresses the 10–15% revenue loss problem mentioned earlier, essentially plugging the holes in the bucket. Moreover, these systems can enforce consistency – the AI doesn’t forget to record an item the way a human might in a hectic moment – and thus supports compliance (all required device info gets recorded every time).

Integration with Clinical and Billing Systems:

AI tracking solutions are designed to integrate seamlessly with electronic health records (EHR), enterprise resource planning (ERP) systems, and billing software. When a nurse captures an implant via the AI system, the data flows into the patient’s chart (for the clinical record and to satisfy UDI documentation requirements) and into the billing/charge master system (for financial reporting). This eliminates duplicate data entry – previously, an OR nurse might document in the clinical record and then someone in billing had to re-enter the items into the financial system. Now it’s one capture for both purposes. Integration also allows real-time checks: for example, the system can validate that the item is on contract and priced correctly. Snap&Go, for instance, maps each implant to the correct medical coding known as the charge code and verifies contract pricing on the fly. This helps avoid pricing errors that could lead to claim denials or disputes. It also means supply chain managers get immediate visibility of what was used, so they can manage inventory replenishment or vendor billing promptly. In a bundled payment world, this level of integration is valuable for cost accounting – hospitals can quickly analyze the total cost of each case, since the data isn’t waiting for someone to input days later. They can know, for example, the exact cost of implants a specific surgeon used in a hip replacement and compare it to the target budget.

Alerts and Patient Safety Features:

Another advantage of AI-driven systems is the ability to incorporate safety checks automatically. For instance, as soon as an implant’s UDI is captured, the system can cross-reference it against databases for recalls or expirations. If the nurse accidentally picks an implant that was expired or recalled implant, the system can flash an on-the-spot alert before the implant is used. This “last line of defense” can prevent serious patient safety events and regulatory non-compliance. Similarly, when documenting tissue implants or devices, the system ensures the required info (like lot numbers) is captured, which is critical for regulatory tracking. In the event of a future recall, having every implant’s details in a searchable database means the hospital can immediately identify which patients are affected, thanks to the thorough documentation. This is a huge improvement over rifling through paper logbooks or incomplete records. In short, AI solutions not only help financially but also enhance safety and quality compliance – an important consideration as TEAM also measures quality outcomes (readmissions, complications) that factor into reconciliation.

Data Analytics and Decision Support:

With automated tracking in place, hospitals will accumulate a trove of data on implant usage and costs. Modern systems include analytics dashboards to capitalize on this information. They can produce reports on cost-per-case, compare implant utilization and costs across surgeons, and identify trends or outliers. For example, a hospital could see that Surgeon A consistently uses $2,000 more in implant costs for a similar procedure than Surgeon B, leading to a conversation about standardization or technique differences. Or the data might show that a certain implant model is associated with higher usage of certain supplies or longer OR times, prompting further examination. These insights are crucial under TEAM, where finding efficiencies is key. By analyzing data captured through AI, hospitals can drive value-based improvements – perhaps negotiating better prices for the most-used implants, phasing out a product that doesn’t justify its cost, or sharing best practices among surgeons to reduce variability. Essentially, the AI-based documentation provides the granular dataset needed for continuous improvement in a bundled payment environment. In the past, such analysis was hard because data was incomplete or not timely; now, with every implant digitally tracked, the supply chain and finance teams have up-to-the-minute information to guide strategy.

Beyond Barcodes – Why AI is Gaining Favor:

Some might wonder, “Didn’t we already solve this with barcode scanners?” Barcoding has been around for years, and many hospitals have tried implementing barcode scanning in the OR to track implants. While barcode systems provide some level of efficiency, they come with significant medical coding and documentation challenges.

One major issue is staff compliance—in the fast-paced surgical environment, scanning every item can be skipped or overlooked. Barcode confusion is another problem. Implant packaging often contains multiple barcodes, including UDI, lot numbers, and catalog numbers, making it easy to scan the wrong one or miss crucial details required for accurate medical coding and charge capture. Additionally, not all implants have standardized barcodes that integrate smoothly with hospital inventory systems, creating gaps in documentation that impact both reimbursement and compliance.

AI-powered image recognition eliminates these barriers by automating medical coding and implant tracking. Instead of relying on manual barcode scanning, AI can instantly capture all necessary details from an implant package with a simple image, extracting the full UDI, serial numbers, and expiration dates automatically. Early adopters report that AI-based systems dramatically reduce documentation time and errors, ensuring that every implant used is properly coded, billed, and accounted for.

Hospitals using AI-powered medical coding solutions have already seen a significant financial impact. One hospital using AI vision technology achieved full capture of implant charges, where previously a substantial portion went unbilled due to missing barcode scans. The technology continues to advance rapidly, with RFID-based solutions (such as smart cabinets) also being used for real-time implant tracking.

The common goal across these technologies is to automate the capture of implant data at the point of use, ensuring that no revenue is lost and all compliance requirements are met—without burdening clinical staff. Given the thin margins that the TEAM model will impose, AI-driven medical coding and charge automation are becoming essential, not optional. The American Hospital Association has recognized AI-driven revenue cycle tools as a key innovation to help hospitals optimize financial performance under new reimbursement models.

From a financial perspective, implementing an AI tracking solution requires upfront investment and training, but the ROI is strong. Recovering the 10–15% of lost implant charges and reducing manual labor results in a fast payback. Furthermore, the improved data integrity protects hospitals during audits, providing an accurate, auditable trail for every implant.

Many hospitals are already piloting these AI-based systems in orthopedic ORs ahead of TEAM’s 2026 launch, ensuring their medical coding and charge capture processes are airtight before the new payment structure takes effect. As TEAM shifts more financial risk onto providers, forward-thinking hospitals are leveraging AI and digital tools to mitigate that risk internally—ensuring every implant is tracked, every charge is captured, and every claim is fully reimbursed.

Conclusion: Preparing for Success Under TEAM

The CMS TEAM model signals a major shift in how surgical care is financed, placing hospitals directly accountable for both the cost and quality of care throughout an episode. Medical coding now plays a central role in this transition, as hospitals can no longer separately bill for high-cost implants. Instead, accurate coding, charge capture, and compliance are essential for ensuring that every implant decision is value-driven and every used implant is properly documented and reimbursed.

Hospitals must align clinicians, supply chain teams, and medical coding specialists to optimize costs while maintaining high-quality patient care. Implant selection must balance cost-effectiveness and outcomes, requiring collaborative decision-making with surgeons and full transparency in pricing and utilization. However, even the best procurement strategies will fail if medical coding inaccuracies lead to lost reimbursements, claim denials, or compliance risks. Under TEAM, precise medical coding is no longer just about maximizing revenue—it determines whether a hospital loses or earns money on each surgical episode.

The hospitals best positioned to succeed under the TEAM model are those that proactively adapt by renegotiating supplier contracts, educating surgeons on cost-conscious implant selection, and improving operational efficiency in both perioperative workflows and medical coding processes. Many organizations are already reviewing baseline data to pinpoint where costs are highest, where medical coding gaps exist, and where documentation improvements are needed. This level of introspection, paired with modern AI-driven tools, turns the TEAM model from a financial threat into an opportunity—an opportunity to eliminate inefficiencies, reduce waste, and streamline reimbursements while maintaining excellent patient outcomes.

Ultimately, success under bundled payments hinges on delivering the best care at the lowest practical cost while ensuring flawless medical coding and documentation. High-cost implants and complex medical coding requirements have historically made this a challenge, but with the right strategies, hospitals can overcome these obstacles. By fostering collaboration across clinical, administrative, and medical coding teams and leveraging AI-driven tracking and automation, hospitals won’t just comply with CMS’s new model—they will thrive in it.

The healthcare industry is rapidly shifting toward value-based care, and the TEAM model is accelerating this transformation. Hospitals that recognize the urgency of refining their medical coding, charge capture, and financial workflows will set the standard for efficiency and excellence. With TEAM’s mandatory implementation in 2026, now is the time to act—ensuring that systems are aligned, medical coding processes are optimized, and all stakeholders are prepared for the shift. Those who take proactive steps today will turn TEAM into a win-win: better-coordinated care for patients and a more accountable, financially sustainable model for hospitals