What’s inside:

- How AI is transforming the entire revenue cycle

- Why accurate, complete data is the foundation of a successful revenue cycle

- Using AI to enhance patient experience and collections

- Ways to incorporate AI revenue cycle management strategies

The healthcare revenue cycle is under growing pressure: shrinking margins, rising claim denials, staffing shortages, and increasingly complex billing requirements strain hospital finance teams. As organizations move deeper into value-based care and bundled payment models, the need for automation, visibility, and accuracy across every stage of the revenue cycle has never been greater.

AI revenue cycle management has emerged as a critical strategy to streamline workflows, prevent denials, and improve financial performance. By combining automation, predictive analytics, and intelligent dashboards, AI is transforming how hospitals manage patient access, clinical documentation, billing, and reimbursement.

In 2025 and beyond, these five AI trends will redefine how hospitals, clinics, and health systems manage the entire revenue cycle, from the moment a patient schedules an appointment to the moment payment is collected.

Why AI Matters Across the Revenue Cycle

Revenue cycle management includes every touchpoint between the patient encounter and final reimbursement. This spans:

- Front-end workflows: registration, eligibility verification, insurance discovery, prior authorization

- Mid-cycle workflows: clinical documentation, coding, charge capture, revenue integrity

- Back-end workflows: billing, claims submission, denials, payment posting, patient collections

Traditional, manual processes struggle to keep up with regulatory changes, payer requirements, and rising administrative costs. HFMA reports that commercial claim denials have increased more than 20% in recent years, while administrative staffing shortages continue to disrupt financial operations.

AI revenue cycle management addresses these challenges by automating repetitive work, improving documentation accuracy, and generating real-time financial insights. And throughout the revenue cycle, accurate supply and charge capture data play a critical role in supporting clean claims and preventing revenue leakage.

Which AI Trends Are Transforming Hospital Revenue Cycles?

1. Predictive Analytics to Prevent Denials and Speed Reimbursement

AI-driven predictive analytics is becoming a cornerstone of revenue cycle strategy. By analyzing historical claims data, payer behavior, and patient profiles, AI can forecast which claims are at risk of denial and identify opportunities for faster payment.

This proactive approach allows healthcare providers to prioritize high-value claims, reduce payment delays, and improve cash flow.

Predictive models perform best when the operational data feeding them is complete and accurate. Incomplete documentation or missed charges introduce blind spots that weaken denial prediction and reimbursement forecasting. AI-enabled point-of-use data capture helps close these gaps by ensuring that clinical and supply usage data is captured the first time correctly, before the claim ever reaches the payer.

Why it matters: Predictive analytics helps hospitals prevent problems before they occur, reducing denial risk and enabling revenue teams to focus on the highest-value claims.

2. AI-Powered Claims Processing Reduces Errors and Costs

Manual claims processing is time-consuming and error-prone. AI-driven claims management systems automatically review, validate, and submit claims, detecting inconsistencies before they become costly denials.

With machine learning and natural language processing (NLP), these tools continuously improve coding accuracy by interpreting physician notes and suggesting compliant codes.

Accurate supply documentation also plays a major role in reducing billing errors. Automated charge capture solutions, like Snap&Go, ensure that every item used in patient care is recorded accurately and consistently. This not only supports cleaner claims but also reduces bill lag and eliminates costly rework.

Because missed charges represent pure lost revenue, accurate point-of-care capture is essential for protecting margins, especially in surgical and procedural environments.

Why it matters: AI claims processing increases accuracy and reduces administrative burden by automating reviews, minimizing coding errors, and lowering the overall cost of managing claims.

3. AI Transforms Denial Management from Reactive to Proactive

Within AI revenue cycle management, denial prevention and mitigation represent some of the highest-value opportunities. AI supports denial management by identifying patterns in denied claims, recommending corrective actions, and predicting which claims are likely to be rejected.

Some advanced AI automation in hospital finance tools can even auto-appeal simple denials, freeing teams to focus on complex cases.

Most importantly, AI helps organizations understand why denials occur. And consistently, the data shows that mid-cycle issues, such as documentation gaps, incorrect coding, and inconsistent supply capture, are the leading causes of preventable denials. AI strengthens these areas by flagging missing information before claims are submitted and ensuring documentation holds up under payer scrutiny.

Why it matters: AI turns denial management into a proactive, data-driven strategy, minimizing lost revenue and improving cash flow predictability.

4. AI Personalizes Patient Billing for Higher Collections

AI isn’t just transforming backend workflows; it’s reshaping the patient financial experience. Predictive models can forecast payment behavior, allowing providers to offer personalized payment plans or targeted financial guidance.

AI chatbots and virtual assistants can answer billing questions, send reminders, and help patients navigate their financial responsibilities.

On the back end, AI automates payment posting by reading payer remittances, matching payments to accounts, and flagging underpayments or anomalies for review. This reduces manual posting time and ensures financial records are accurate.

Accurate patient billing relies on complete documentation and charge capture at the point of care. When every service and supply used in an encounter is properly accounted for, billing teams avoid disputes, rebilling cycles, and delays caused by missing or incorrect data.

Why it matters: Personalized billing improves patient satisfaction, boosts collection rates, and leads to a smoother billing experience, while also reducing costs associated with manual follow-up.

5. Real-Time Insights with AI Revenue Cycle Management Dashboards

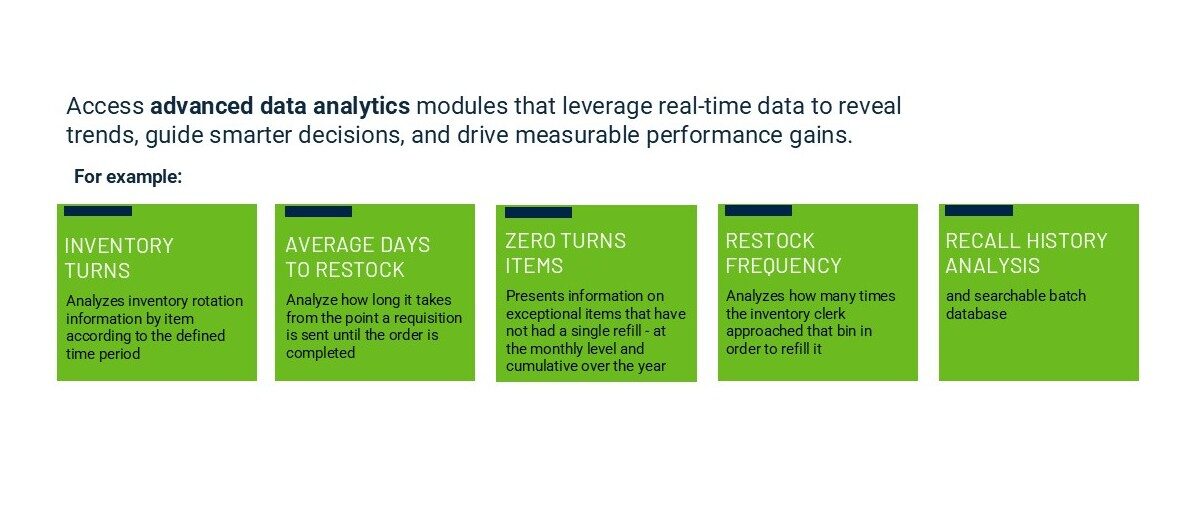

Healthcare organizations are increasingly relying on AI-powered dashboards, like the IDENTIPlatform, to gain real-time visibility into revenue cycle performance. These dashboards track metrics such as days in accounts receivable, denial rates, and reimbursement trends and provide actionable insights across the entire revenue cycle, integrating data from patient access, clinical systems, supply chain, and billing.

By pulling together operational and financial data, AI can highlight bottlenecks, reveal revenue leakage, and forecast performance. Supply and charge capture data, often overlooked in traditional dashboards, provides critical insight into where accuracy breaks down and where revenue is being lost.

Why it matters: Real-time insights empower leadership to make data-driven decisions, optimize processes, and protect financial health.

The Future of AI Revenue Cycle Management

As healthcare moves deeper into value-based reimbursement and bundled payment models, AI revenue cycle management will evolve into an enterprise-wide intelligence layer connecting clinical, operational, supply chain, and financial data.

Because a large portion of hidden revenue loss comes from mid-cycle breakdowns: missed charges, incomplete documentation, and inaccurate supply capture, organizations that invest in automated point-of-care solutions will retain more revenue and reduce denials.

Hospitals that adopt AI-driven revenue cycle solutions can expect faster reimbursements, fewer denials, improved cash flow, and greater operational efficiency.

As reimbursement models continue to evolve, embracing automation across hospital finance will be essential for long-term sustainability, profitability, and strategic decision-making.

See how IDENTI’s accurate charge capture and real-time documentation solutions help strengthen the entire revenue cycle from the point of care forward.

Contact us today for a demo of Snap&Go.